the New Price Comparator in France: MagicPrices.fr

MagicPrices.fr, the new price comparator, is set to revolutionize online shopping in France. This innovative platform is key to a smart shopping experience, enabling users to save and find the best deals on the market.

Save by Choosing the Right Product

MagicPrices.fr allows users to compare thousands of products from different online stores. The platform helps in choosing the right product at the best price, guaranteeing significant savings. Thanks to its sophisticated comparison algorithm, users will always find the cheapest option without having to spend hours searching manually.

Discover the Best Offers on the Market

MagicPrices.fr goes beyond simple price comparisons. It offers access to exclusive discounts, coupons, and special promotions. The list of offers is updated daily, ensuring users always have the best deals at their fingertips. Whether looking for electronics, clothing, appliances, or more, MagicPrices.fr shows how to get the most out of a budget.

Personalized Support with the Product Assistant

Understanding the technical specifications of a product can be complicated, but with MagicPrices.fr, users are never alone. The product support assistant is always available to provide detailed explanations and personalized advice. Whether needing to know which smartphone has the best camera or which washing machine is most energy efficient, the assistant guides users towards informed and convenient choices.

A New Way of Shopping Online

MagicPrices.fr is more than just a website; it is a trusted partner for smart and convenient shopping. Users are encouraged to join and discover how to transform their shopping experience, saving both time and money. MagicPrices.fr offers the opportunity to have all the best on the market just a click away.

MagicPrices.fr represents a revolution in the world of online shopping in France. The ability to compare prices and discover exclusive offers is a significant added value for consumers, who can make informed and convenient purchases. Personalized support from the Product Assistant makes the experience even more complete, helping users navigate the various options available with expertise and confidence. MagicPrices.fr is the ideal solution for anyone looking to optimize their purchases without compromising on quality.

Data Pipeline Overview

Spread Trading: A Simple Guide to Understanding this Strategy

Trading is a complex and diverse world with many different strategies and approaches. Among these strategies, one of the most intriguing and often less well-known is spread trading. In this article, we will guide you through the basic concepts of spread trading in a simple and understandable way.

What is Spread Trading?

Spread trading is a strategy that involves the simultaneous buying and selling of two related financial instruments. The primary goal is to capitalize on changes in the relative prices of the two instruments rather than betting directly on the market’s direction.

Imagine having two financial instruments, such as two different company stocks or two stock index futures. In spread trading, you would buy one contract of one of them and sell one contract of the other at the same time. This strategy is based on the belief that the relationship between the two instruments will move in a certain direction.

A Simple Example

To make this strategy clearer, let’s consider a concrete example:

Suppose you are observing two automobile companies, A and B. You notice that over time, the price of A’s stocks tends to rise when the price of B’s stocks falls, and vice versa. This is a good example of a negative correlation between two financial instruments.

In traditional trading, you might decide to buy shares of A if you think they will increase in value. However, with spread trading, you would take a different approach. You would buy one contract of A’s stocks and, simultaneously, sell one contract of B’s stocks. This way, your profit would depend on the price difference between the two stocks.

If A’s stocks increase in value while B’s stocks decrease in price, you’ll profit from the difference in those price movements. Furthermore, this strategy reduces overall risk because you are long on one stock and short on the other.

Risk Management

In the world of trading, risk management is essential, and spread trading is no exception. You can set stop-loss orders to protect your capital and take-profit orders to lock in your desired gains.

It’s also important to keep an eye on the correlation between the two instruments you are trading. A negative correlation, as in our example, implies that the two instruments tend to move in opposite directions. But correlations can change over time, so ongoing monitoring is crucial.

Conclusion

Spread trading is an advanced trading strategy, but it can be approached relatively simply if you understand the basic concepts. Instead of betting on the market’s direction, you’re betting on the price difference between two related instruments. This strategy can reduce overall risk and offer profit opportunities even in volatile markets. However, it’s essential to study and thoroughly understand the markets and the correlations between the instruments before starting to engage in spread trading.

Trading Commodities

Commodity Trading Dashboard

Fundamental analysis and technical analysis, the major schools of thought when it comes to approaching the markets, are at opposite ends of the spectrum. Both methods are used for researching and forecasting future trends in stock prices, and, like any investment strategy or philosophy, both have their advocates and adversaries.

To much information to check in few time and from several resources

Psychology effect on financial decision coming from traditional media and social network. These emotional can trigger irrational decision-making that costs investors money

Works on seasonality basis, increases winning probability, enables to predict increase or decline of price

The goal of the post is to stimulate everyone’s participation in commodity trading.

In particular, the idea is to create a section dedicated to Commodity Trading with the aim of collecting all the information necessary to trade commodities on a single page per commodity. Fundamental data, futures prices, exports, exchange rates, the main government reports USDA, Wasde, weather forecast, social sentiment.

All on one single page, commodity trading dashboard, click here

Big Ideas 2021

Deep Learning

Until recently, humans programmed all software. Deep learning, a

form of artificial intelligence (AI), uses data to write software. By

“automating” the creation of software, deep learning could

turbocharge every industry.

The Re-Invention of the Data Center

In the data center, we believe accelerators, dominated by GPUs, will

become the dominant processors for new workloads, growing 21% at

an annual rate to $41 billion by 2030.

Virtual Worlds

Today, virtual worlds are independent from each other, but in the

future they could become interoperable, culminating in what

futurists have deemed ‘The Metaverse.’

Digital Wallets

Today, digital wallets are beginning to penetrate the full traditional

financial services stack, including brokerage and lending. Digital

wallets could serve as lead generation platforms for commercial

activity beyond financial products.

Bitcoin’s Fundamentals

Based on search volumes compared to 2017, bitcoin’s price increase

seems to be driven less by hype. With bitcoin appearing to gain

more trust, some companies are considering it as cash on their

balance sheets.

Electric Vehicles (EVs)

We believe the biggest downside risk to our forecast is whether

traditional automakers can transition successfully to electric and

autonomous vehicles.

Automation

Automation has the potential to shift unpaid labor to paid labor.

For example, as food services automate, they will transform food

prep, cleanup, and grocery shopping into market activities including

food delivery.

Autonomous Ride-Hailing

We believe autonomous ride-hailing will reduce the cost of mobility

to one tenth the average cost of a taxi today, spurring widespread

adoption.

Drone Delivery

Lower battery costs and autonomous technology should

power aerial drones.

Orbital Aerospace

Thanks to advancements in deep learning, mobile connectivity,

sensors, 3D printing, and robotics, costs that have been

ballooning for decades are beginning to decline. As a result,

the number of satellite launches and rocket landings is

proliferating.

3D Printing

3D printing collapses the time between design and production,

shifts power to designers, and reduces supply chain

complexity, at a fraction of the cost of traditional manufacturing.

Long-Read Sequencing

Next-generation DNA sequencing (NGS) is the driving force behind

the genomic revolution. Though historically dominated by shortread sequencing, we believe long-read sequencing will gain share at a rapid rate.

Multi-Cancer Screening

According to ARK’s research, the convergence of

innovative technologies has pushed the cost of multi-cancer

screening down by 20-fold from $30,000 in 2015 to $1,500 today

and it should drop another 80%+ to $250 in 2025.

Cell and Gene Therapy: Generation 2

The second generation of cell and gene therapies should shift from:

• liquid to solid tumors

• autologous to allogeneic cell therapy1

• ex vivo to in vivo gene editing

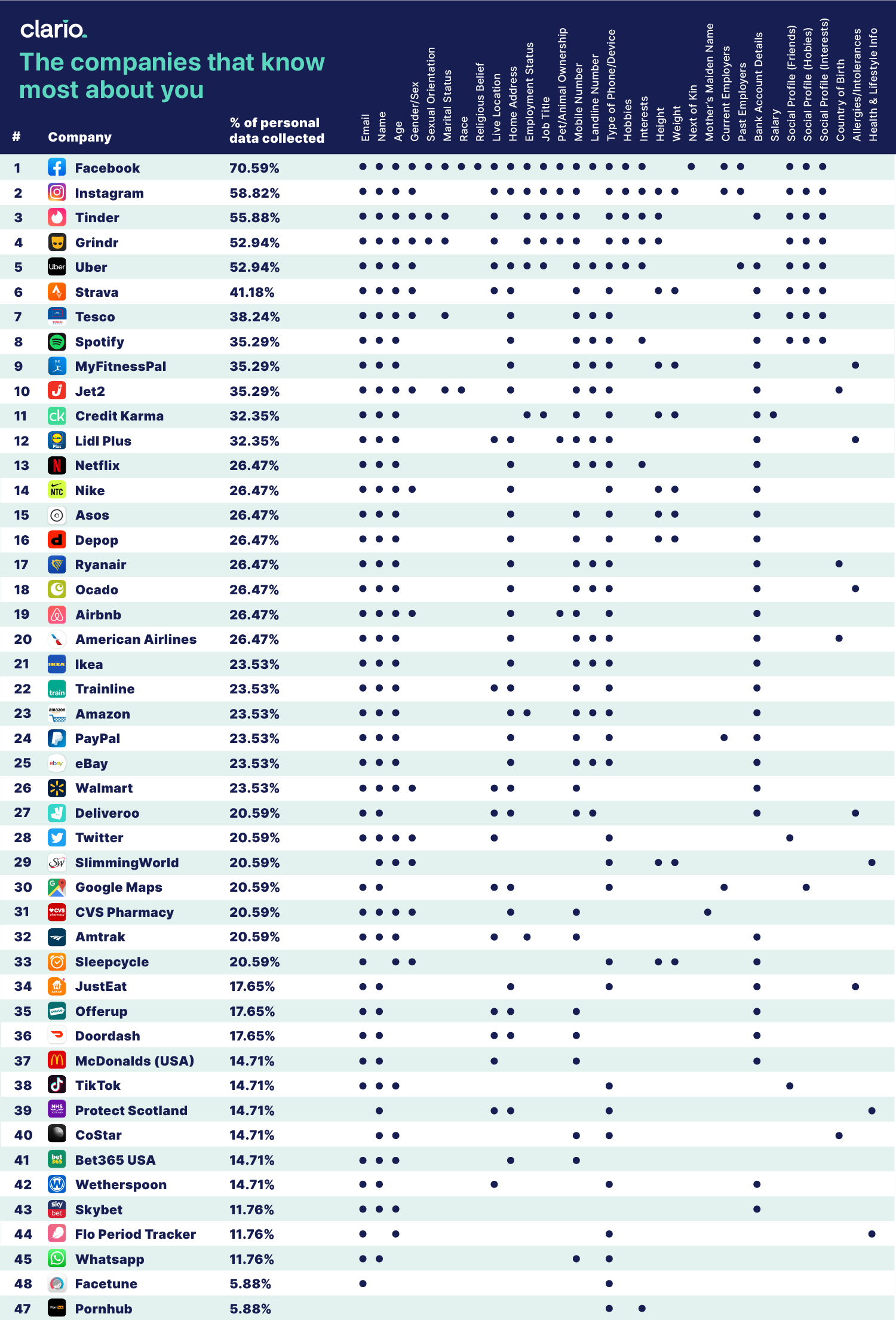

Which Company Uses the Most of Your Data?

Big brother brands report: which companies track our personal data the most?